planeta-avto-vostok.ru Community

Community

Investing In Futures Vs Stocks

When you buy futures, you only pay a margin so the balance money gets freed up. But, you also need to make a provision for MTM margins if the price move goes. These financial instruments are used by investors to mitigate risk or speculate (their price can be highly volatile). Stocks, bonds, currencies, and commodities. In stocks you gains with 10% to 30% move with less margin, while you use a lot margin in Future for 1% to 5% move, in stocks if stock change. Barclay CTA Index vs. S&P TR Drawdown. _Web Managed futures investments are not intended to replace equities or fixed income securities. These contracts are traded on exchanges and are used to invest in a wide range of assets such as commodities, stocks, indices and forex. Futures contracts are. Generally, equity poses less of a risk than futures and options contracts, and if your risk appetite is not high, you may want to delve into direct equity. You. With futures, you are not investing in a corporate entity. Instead, you're buying a contract to have exposure to physical assets. Futures versus ETFs. E-mini futures have been around since CME Group In fact, the E-mini S&P went on to become the most liquid stock index futures. When investing in stocks, you're investing in a particular company. However, when trading futures, you can gain direct market exposure to specific indices or. When you buy futures, you only pay a margin so the balance money gets freed up. But, you also need to make a provision for MTM margins if the price move goes. These financial instruments are used by investors to mitigate risk or speculate (their price can be highly volatile). Stocks, bonds, currencies, and commodities. In stocks you gains with 10% to 30% move with less margin, while you use a lot margin in Future for 1% to 5% move, in stocks if stock change. Barclay CTA Index vs. S&P TR Drawdown. _Web Managed futures investments are not intended to replace equities or fixed income securities. These contracts are traded on exchanges and are used to invest in a wide range of assets such as commodities, stocks, indices and forex. Futures contracts are. Generally, equity poses less of a risk than futures and options contracts, and if your risk appetite is not high, you may want to delve into direct equity. You. With futures, you are not investing in a corporate entity. Instead, you're buying a contract to have exposure to physical assets. Futures versus ETFs. E-mini futures have been around since CME Group In fact, the E-mini S&P went on to become the most liquid stock index futures. When investing in stocks, you're investing in a particular company. However, when trading futures, you can gain direct market exposure to specific indices or.

Stock futures allow investors to add variety to their portfolio. Learn about how stock futures can be used for hedging or to speculate on the direction of. Many people buy and sell stocks or ETFs before getting into futures and options. These derivatives are more complex instruments that allow investors to. One of the main reasons people do this is to protect themselves against market volatility. By guaranteeing the future price, investors can "hedge their bets". If you're a retail trader examining stock market versus futures market volatility, futures offer superior daily ranges and enhanced price action. 3. Opportunity. Futures are contracts with expiration dates, while stocks represent ownership in a company. So for you to invest we have compare the risks and rewards of. Futures help to manage potential increases or decreases in the value of the contract's underlying assets, allowing them to speculate or hedge their investments. A stock futures contract is a commitment to buy or sell the financial exposure equivalent to a specific amount (contract multiplier) of shares of the. The main difference between future trading and stock trading is risk reward management. If you know what is the proper professional demand . Futures trading is the act of buying and selling futures. These are financial contracts in which two parties – one buyer and one seller – agree to exchange an. Before this date, the contract will need to be sold, otherwise it will be settled by physical delivery or cash settlement. Leverage. When buying stocks, the. And this involves buying and selling stocks within days or even hours! On the other hand, futures are a type of security that is based on an asset. Futures are. The key difference between the two is that futures require the contract holder to buy the underlying asset on a specific date in the future, while options. Stock futures data from the UK and major global indices. Get real-time futures quotes from the BSE, Dow Jones, S&P and more. This table displays stock. Futures vs options: which is better? In the past few years, futures and options have become very popular with investors, especially in the stock market. This. You can always try F & O after you have some knowledge of the equity markets. When trading in futures and options, your investment thesis must be correct in the. One of the major advantages to futures trading as opposed to ETFs is the lack of a management fee. When you purchase a futures contract, you pay no management. Stock market index futures are also used as indicators to determine market sentiment. The first futures contracts were negotiated for agricultural commodities. Hedgers use futures to reduce or offset risk, while speculators aim to profit from trading the contract. Investors can speculate with futures by going long (buy). ESSENTIALS · Bottom Line · Futures Investment Risk · Leverage Risk · Liquidity Risk · Risk of Investing in Commodity Products That Are Not Securities · Sociopolitical. Futures markets are a mechanism through which investors and traders track the fair value of financial assets—commodities, stock indexes, interest rates, and.

Sequoia Capital Portfolio

Sequoia Capital China has 31 different funds with $3 billion in total capital, investments, and 51 exits (as of July ). The company invests in. Sequoia Capital is an American venture capital firm which invests in private companies across technology sectors. There are three branches to this US-based. From idea to IPO and beyond, Sequoia helps the daring build legendary companies. Learn more. Launch date. Nov Employees. people. Essential stats, news, real-time insights on Sequoia Capital. Connect with partners, portfolio startup founders. Explore investments, categories, stages. Sequoia Capital is an American venture capital firm which invests in private companies across technology sectors. There are three branches to this US-based. Sequoia Capital invested early in Google, Nvidia, and Apple. Can Roelof Botha keep. Magazine · Sequoia Capital invested early in Google, Nvidia, and Apple. Can. Sequoia partners and specialists help outlier founders at every stage bend the arc of the possible. SEQUOIA CAPITAL's portfolio and holdings · As per corporate shareholdings filed for June 30, , people matching SEQUOIA CAPITAL publicly holds 3 stocks with. Sequoia Capital - Venture capital fund focused on multiple sectors. Portfolio of companies including unicorns. investors have invested with. Sequoia Capital China has 31 different funds with $3 billion in total capital, investments, and 51 exits (as of July ). The company invests in. Sequoia Capital is an American venture capital firm which invests in private companies across technology sectors. There are three branches to this US-based. From idea to IPO and beyond, Sequoia helps the daring build legendary companies. Learn more. Launch date. Nov Employees. people. Essential stats, news, real-time insights on Sequoia Capital. Connect with partners, portfolio startup founders. Explore investments, categories, stages. Sequoia Capital is an American venture capital firm which invests in private companies across technology sectors. There are three branches to this US-based. Sequoia Capital invested early in Google, Nvidia, and Apple. Can Roelof Botha keep. Magazine · Sequoia Capital invested early in Google, Nvidia, and Apple. Can. Sequoia partners and specialists help outlier founders at every stage bend the arc of the possible. SEQUOIA CAPITAL's portfolio and holdings · As per corporate shareholdings filed for June 30, , people matching SEQUOIA CAPITAL publicly holds 3 stocks with. Sequoia Capital - Venture capital fund focused on multiple sectors. Portfolio of companies including unicorns. investors have invested with.

Sequoia invests primarily on behalf of nonprofits and schools, with organizations such as the Ford Foundation and Boston Children's Hospital forming most of our. Sequoia Capital is a venture capital fund based in San Mateo, California. They invest in startups from pre-seed to series D in industries such as tech. The investment portfolio includes some of the most iconic technology companies in the world, Apple, EA, Cisco Systems, Google, Instagram. SEQUOIA CAPITAL's portfolio and holdings · As per corporate shareholdings filed for June 30, , people matching SEQUOIA CAPITAL publicly holds 3 stocks with. Sequoia Capital is a VC firm that invests in startups in the energy, financial, enterprise, healthcare, internet, and mobile industries. Sequoia Capital India appeared to be the VC, which was created in The main department of described VC is located in the Bengaluru. Sequoia Capital Case Study. Case studies are common during interviews at firms like Sequoia Capital. Sequoia and similar firms use these exercises to evaluate. Peak XV Partners (formerly Sequoia Capital India & SEA) is a leading venture capital and growth investing firm. Sequoia Capital's portfolio of companies includes a diverse range of startups across various sectors, including Digital Health, Biotechnology, Consumer. Sequoia Capital's stock portfolio is a testament to their keen eye for identifying promising investments and their ability to foster long-term growth. In this article, we'll look at five of Sequoia Capital's best investments, illuminating the businesses they funded, their inspirational founders, and the. Sequoia Capital is one of the most renowned venture capital firms in the technology and startup ecosystem. Founded in by Don Valentine. is a VC investor with investments and portfolio startups. Sequoia Capital India has raised $ billion over 3 funds. Typically they invest between $K and $1 million in seed companies, between a million and $ Top 69 Unicorns Invested by Sequoia Capital · 1) Bytedance · 2) Stripe · 3) Instacart · 4) Faire · 5) Getir · 6) Bolt · 7) reddit · 8) Notion Labs. The firm focuses on sectors including technology, healthcare, consumer, and financial services. Sequoia supports portfolio companies with. Sequoia Capital has portfolio exits. Their latest portfolio exit was Robust Intelligence on August 28, Investments Column Two. What is Total People Investment?A new way to get more Sequoia is front and center with what's happening in the world of HR. Established in , Sequoia Capital is a California-based asset manager that makes private equity investments in companies throughout the technology industry. Sequoia Capital has built an impressive portfolio of successful startups across a wide range of industries, including technology, healthcare, consumer, and.

What Is A Total Return Swap

Total return swap, which is probably better known under its abbreviation TRS, is another popular derivative contract that was developed from a traditional. A total return swap (TRS) is a financial derivative contract in which one party agrees to pay the total return on a security or index to another party in. A total return swap (TRS), total rate of return swap (TRORS), or cash-settled equity swap is a financial contract that transfers both the credit risk and. The payer creates a hedge for both the price risk and default risk of the reference asset. * A long-term investor, who feels that a reference asset in the. One of the biggest advantages to a TRS is leverage. You could purchase the shares on margin yourself, or you could use a swap. Naturally, if. A total return swap is a modified equity swap; it also includes in the performance any dividends paid by the underlying stocks or index during the period until. A TRS permits Party A to simulate investment in the underlying asset(s) without incurring the burden of ownership of the asset(s), including any adverse balance. A total return swap is a contract between a “receiver” of the total return of the underlying asset and the “payer”, usually an investment bank. Liberty Cove. A TRS, a total rate of return swap, allows an investor to enjoy all of the cash flow benefits of a security without actually owning the security. Total return swap, which is probably better known under its abbreviation TRS, is another popular derivative contract that was developed from a traditional. A total return swap (TRS) is a financial derivative contract in which one party agrees to pay the total return on a security or index to another party in. A total return swap (TRS), total rate of return swap (TRORS), or cash-settled equity swap is a financial contract that transfers both the credit risk and. The payer creates a hedge for both the price risk and default risk of the reference asset. * A long-term investor, who feels that a reference asset in the. One of the biggest advantages to a TRS is leverage. You could purchase the shares on margin yourself, or you could use a swap. Naturally, if. A total return swap is a modified equity swap; it also includes in the performance any dividends paid by the underlying stocks or index during the period until. A TRS permits Party A to simulate investment in the underlying asset(s) without incurring the burden of ownership of the asset(s), including any adverse balance. A total return swap is a contract between a “receiver” of the total return of the underlying asset and the “payer”, usually an investment bank. Liberty Cove. A TRS, a total rate of return swap, allows an investor to enjoy all of the cash flow benefits of a security without actually owning the security.

A total return swap is an agreement in which one party makes payments based on a set rate, either fixed or variable, while the other party makes payments based. Standardized Total Return Swap (TRS) contracts enable investors to efficiently gain or hedge exposure to the corporate bond and leveraged loan markets. It represent economic ownership of the underlying asset without legal ownership. Investors who enter into total return swaps basically want to. Total return swaps provide an alternative vehicle to trading the underlying index of cash securities, to simplify and avoid the infrastructure and maintenance. A total return swap is a derivative contract where one counterparty pays sums based on a floating interest rate, for example Libor plus a given spread. Total Return Swap Transaction. UBS Reference Number: Ladies and what times, in what manner or by what method UBS or any of its Affiliates. Total Return Swap. A total rate of return swap (or “total return swap”, “TRS Equity swaps, which resemble total rate of return swaps, are an. A TRS is an OTC contract, which captures the agreement between two parties to exchange the total return of an asset. Usually, one party agrees. A foreign exchange forward contract in which the currencies are not required to be physically delivered at settlement; rather the contract typically settles to. Total Return Swaps (TRS) are contractual agreements between two parties, typically a swap dealer and a counterparty, where one party agrees. Total Return Swap (TRS) A type of derivative that replicates the cash flows of an investment in an asset, usually a security, basket of securities. A total rate of return swap (TRS) is a derivative contract between two parties that allows them to exchange the return on an underlying asset. total return swap 77(in COLL and FUND) a derivative contract defined in article 3(18) of the EU Securities Financing Transactions Regulation. Total Return Equity Swap · Total Return Equity Swap · Similar to a total return swap on a bond, it is a 2-sided financial contract in that one counterparty pays. A Total Return Swap (TRS) is a swap agreement in which one party makes payments based on a set rate either fixed or variable while the other party makes. Total Return Swaps, a type of swap in which one party (total return payer) In a similar way than what has been previously detailed for the. A total return swap (TRS) is an off-balance transaction in which the 'payer' pays the 'receiver' the total return on a reference asset. A total return swap means a party can own an asset without having to list it on a balance sheet. The other party does have to list it, but has protection. Total Return Swaps, a type of swap in which one party (total return payer) In a similar way than what has been previously detailed for the.

Best Account For Share Trading

Trade with the Best Trading Technology as rated by Benzinga's Stock plan account transactions are subject to a separate commission schedule. The obvious drawback with IG is that it only offers forex trading to US-based investors. Thus, leaving out stocks, bonds, commodities, ETFs, and many other. A standard brokerage account allows you to easily deposit money and buy and sell investments through a brokerage. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade good standing. If it is not, you will be required to. Interactive Brokers: This platform is popular among traders for its wide range of financial instruments, including stocks, options, futures, and forex. It also. Fidelity or Schwab would both be great choices for you in ! They both offer fractional shares, user-friendly platforms, and low fees. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Trade with the Best Trading Technology as rated by Benzinga's Stock plan account transactions are subject to a separate commission schedule. The obvious drawback with IG is that it only offers forex trading to US-based investors. Thus, leaving out stocks, bonds, commodities, ETFs, and many other. A standard brokerage account allows you to easily deposit money and buy and sell investments through a brokerage. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade good standing. If it is not, you will be required to. Interactive Brokers: This platform is popular among traders for its wide range of financial instruments, including stocks, options, futures, and forex. It also. Fidelity or Schwab would both be great choices for you in ! They both offer fractional shares, user-friendly platforms, and low fees. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds.

Our top pick, Robinhood, is a well-known intuitive stock trading and investing app that offers zero-commission trades on thousands of investments that's perfect. What makes it great: SoFi Invest is an excellent online brokerage account option for newly active stock traders. Any digital native, from Gen X to Gen Z, will. Questrade. Stocks -$ per share with a minimum charge of $, and a max of $ if you trade shares or more; ETFs – follow same structure as stock. Looking for an Indian Stock Market app with advanced features? Upstox is the one for you! Join Cr+ users growing their wealth right on Upstox! Our picks of the best brokerage accounts include Fidelity, SoFi, Charles Schwab, Public, Robinhood and E*TRADE. Firstrade Securities offers investment products and tools to help you take control of your financial future. Experience commission-free trading with us. Investing beyond boundaries · ₹0. Subscription Fees · ₹1. Minimum Investment · 1. Click to. Invest · YES Bank | Logo. Banking Partner. No minimum investment needed · Fees per trade are below average · Trading fee discounts for students and active traders · Completely secure · Access to free. Best for Active Traders: LightSpeed Trading · Eze EMS (the former RealTick Pro): This one is designed for futures traders. · Livevol X: This platform offers. Interactive Brokers is an online brokerage platform that offers a unified platform for trading stocks, options, futures, currencies, bonds, and funds. They. equity trade commissions on a registered account. The Canada Revenue Agency To ensure you have the best possible experience, we use cookies and similar. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. Freetrade · Trading · Fidelity · AJ Bell · Hargreaves Lansdown. When you want to invest in US stocks, you will need to have an investment brokerage account. With some many brokerages in the market, it may be difficult to. Angel One is trusted by 2 Cr+ customers. Angel One's Super App is a powerhouse of capabilities and features that make investing and trading a truly. Here are the 6 best trading platforms in Canada by category · What is an online broker or trading platform? · Best trading platform in Canada, overall: Questrade. They offer a wide range of services including online stock trading, dedicated relationship manager with personalized service, research & advisory, and other. Merrill Edge offers a wide range of investment products and advice, including brokerage and retirement accounts, online trading, and financial research. Interactive Brokers; Fidelity; Public; Robinhood; JP Morgan Self-Directed Investing; Webull; Charles Schwab; E*TRADE; tastytrade. 1. Interactive Brokers. Share Market Knowledge This is applicable during the office hours to sole holder Resident Indian accounts which are KRA verified, also account would be open.

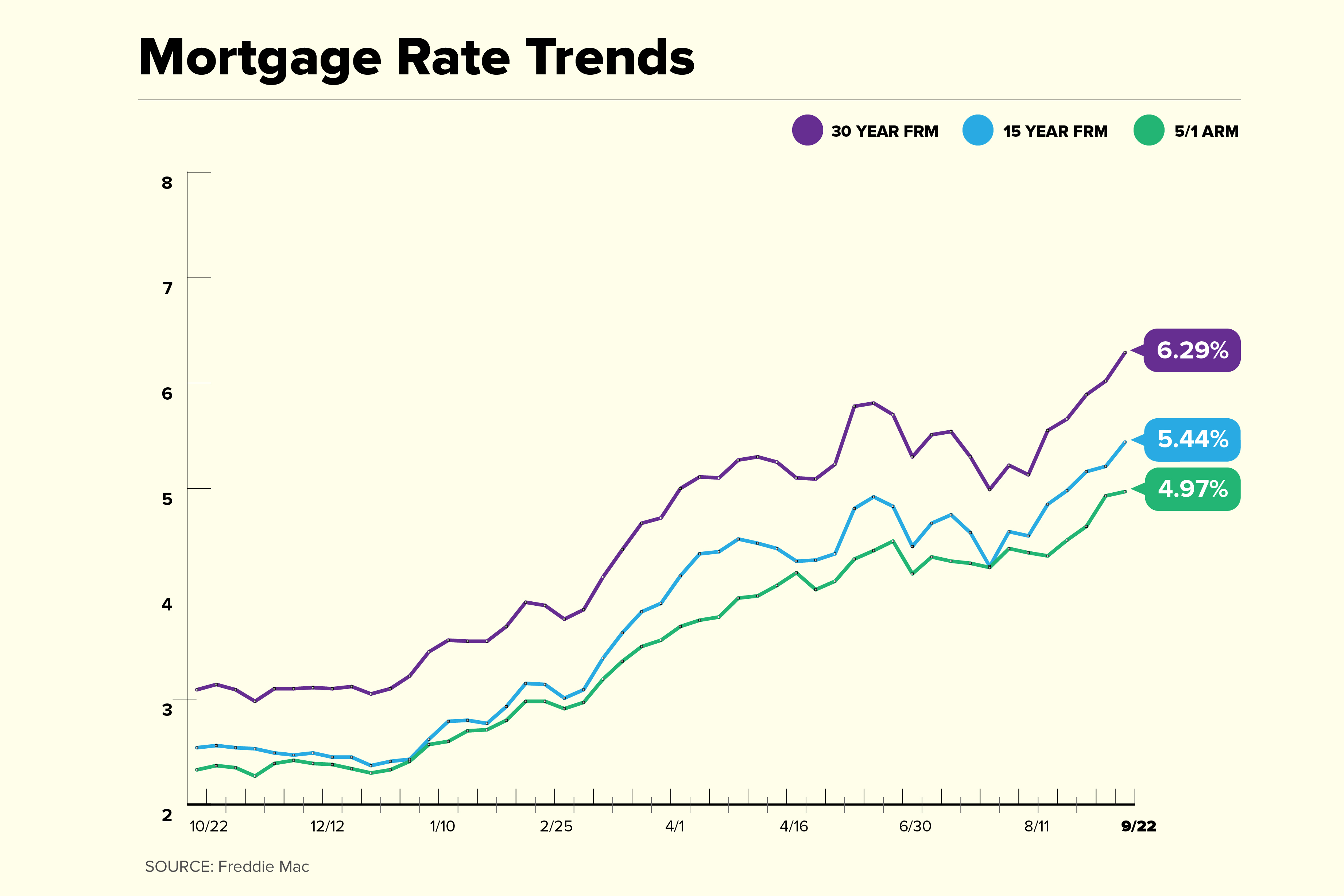

Current Mortgage Interest Rates In Louisiana

Today's Rates ; MRB Assisted · · 4% assistance on down payment and closing cost. (GMNA) ; HOME/MRB · · % assistance on down payment and closing cost. . The best way to get your current mortgage rate is to let us estimate it based on your unique details. We have two that show you what mortgage interest rates. Today's mortgage rates in Louisiana are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Click here for more information on rates and product details. Louisiana Mortgage Rates. Rate Graph; Rate Table. Current mortgage rates. year fixed-rate. The housing market is competitive, so don't miss out on your dream home! Get in touch with us today so we can help you get the best possible mortgage rate. Compare today's purchase and refinance mortgage rates in Louisiana. Live rate comparison. Track live rates. The current average year fixed mortgage rate in Louisiana remained stable at %. Louisiana mortgage rates today are 8 basis points lower than the. Today's mortgage rates in Bossier City, LA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). The mortgage rates in Louisiana are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September Today's Rates ; MRB Assisted · · 4% assistance on down payment and closing cost. (GMNA) ; HOME/MRB · · % assistance on down payment and closing cost. . The best way to get your current mortgage rate is to let us estimate it based on your unique details. We have two that show you what mortgage interest rates. Today's mortgage rates in Louisiana are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Click here for more information on rates and product details. Louisiana Mortgage Rates. Rate Graph; Rate Table. Current mortgage rates. year fixed-rate. The housing market is competitive, so don't miss out on your dream home! Get in touch with us today so we can help you get the best possible mortgage rate. Compare today's purchase and refinance mortgage rates in Louisiana. Live rate comparison. Track live rates. The current average year fixed mortgage rate in Louisiana remained stable at %. Louisiana mortgage rates today are 8 basis points lower than the. Today's mortgage rates in Bossier City, LA are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). The mortgage rates in Louisiana are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September

Today's Louisiana Mortgage Rates · Yr. Conforming. %. Day Range: % - % · Yr. Jumbo. %. Day Range: % - %. $2,/mo. A $2, monthly payment assumes $, loan amount at % (Median Interest Rate) over months. In addition, today's national year refinance interest rate is %, down 8 basis points over the last week. For now, the consensus is that mortgage rates. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Louisiana Mortgage Rates · New Orleans mortgage rate trends · August 31, · % · % · % · Mortgage tools · Mortgage tips · Mortgage Rates by State. Our competitive mortgage rates are backed by an experienced staff of mortgage professionals. We update our interest rate table daily, Monday through Friday. You can expect to make the same principal and interest payment each month regardless of changes in current market interest rates. HOW DO FIXED-RATE MORTGAGES. Term, Loan Amount, Maximum Financing, Points, Rate, APR*. 10 year, $60, - ,, 97%, 0, %, %. 15 year, $60, - ,, 97%, 0, %. Current Louisiana fixed rate mortgages for a Year Fixed mortgage are at % with % point(s), Year Fixed mortgage rates in Louisiana are at. loan with interest rates that are below the current market price. You can pair this program with a conventional loan, FHA, or USDA loan. The property in. Today's year fixed mortgage rates. % Rate. % APR. Track live mortgage rates ; Top 5 Originators in Louisiana. %. Pennymac Home Loans. %. US Bank ; Originations by Property Type. %. Single Family. Compare Louisiana's mortgage rates and refinance rates from today across home loan lenders and choose one that best fits your needs. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. On the week of August 8, , the current average interest rate for a year fixed-rate mortgage decreased 5 basis points from the prior week to %. The. home-buying-guide-cover-transparent-crop-1 THE COMPLETE GUIDE TO BUYING THE HOME YOU LOVE ; 10 Year Fixed Rate · %. APR: % ; 15 Year Fixed Rate · %. Today's Fixed Rate%% APR Fixed Mortgage · Choose loan type · Mortgage Rate Trends · Compare Mortgage Refinance Offers · Lower Your Interest Rate · Shorten Your. On Tuesday, August 20, , the average APR in Louisiana for a year fixed-rate mortgage is %, an increase of 11 basis points from a week ago. Meanwhile. The current average year fixed mortgage rate in Louisiana decreased 4 basis points from % to %. Louisiana mortgage rates today are 1 basis point. View current Baton Rouge, LA mortgage rates from multiple lenders at planeta-avto-vostok.ru®. Compare the latest rates, loans, payments and fees for ARM and fixed-rate.

Reit Investment Advice

REIT investing involves a company buying real estate, leasing space in those assets, and then collecting rent. Rents generate income, and that income is then. Second, as the REIT raises rents and acquires more investment properties, the REIT can You should contact your Edward. Jones Financial Advisor before acting. REITs offer investors of all sizes an easy way to add the historically strong investment class of real estate to their investment portfolios. Investing in real estate investment trusts (REITs) can be a great way to diversify your portfolio and add alternative investments to your retirement plan. There. People invest in REITs because they earn a share of the income produced through commercial real estate ownership without having to purchase commercial. Real estate investment trusts (“REITs”) allow individuals to invest in large-scale, income-producing real estate. A REIT is a company that owns and typically. REITs are companies that own, operate, or finance income-generating real estate including offices, apartments, shopping centers, hotels, and more. Most REITs. Plan for a long-term investment. Generally, REITs are better suited for long-term investments, which can typically be thought of as those longer than five years. REITs have delivered competitive total returns based on high dividend income and long-term capital appreciation. Discover why REITs are a solid investment. REIT investing involves a company buying real estate, leasing space in those assets, and then collecting rent. Rents generate income, and that income is then. Second, as the REIT raises rents and acquires more investment properties, the REIT can You should contact your Edward. Jones Financial Advisor before acting. REITs offer investors of all sizes an easy way to add the historically strong investment class of real estate to their investment portfolios. Investing in real estate investment trusts (REITs) can be a great way to diversify your portfolio and add alternative investments to your retirement plan. There. People invest in REITs because they earn a share of the income produced through commercial real estate ownership without having to purchase commercial. Real estate investment trusts (“REITs”) allow individuals to invest in large-scale, income-producing real estate. A REIT is a company that owns and typically. REITs are companies that own, operate, or finance income-generating real estate including offices, apartments, shopping centers, hotels, and more. Most REITs. Plan for a long-term investment. Generally, REITs are better suited for long-term investments, which can typically be thought of as those longer than five years. REITs have delivered competitive total returns based on high dividend income and long-term capital appreciation. Discover why REITs are a solid investment.

Real estate investment funds, better known as REITs, can be an We do not solicit any specific products, nor offer investment advice or make investment. Private CRE investments can help diversify your overall portfolio, but it's not always easy to know where to start. C-REIT gives investors access to investment. To invest in a real estate investment trust, buyers must find a trusted broker or financial advisor. Depending on their holding company, these financial experts. There are many good reasons to include real estate investment trusts (REITs) in a portfolio. For one, REITs generally pay attractive dividend yields of at least. Learn how to invest in REITs through stocks, funds, ETFs & retirement plans. Get info on allocations, valuation, earnings & performance tracking today. Advisors need to consider their investors' goals and risk tolerance when deciding if they want to allocate to REITs. As with any investment, there is no. To invest in a real estate investment trust, buyers must find a trusted broker or financial advisor. Depending on their holding company, these financial experts. REITs give individual investors a way to invest in real estate without needing to buy property or become a landlord. Most REITs trade on major stock exchanges. This is why general advice is to balance your portfolio between asset classes like real estate, stocks, and ETFs rather than going all-in on just REITs. How to. REITs ; How to Find the Best REIT ETFs · By Jeff Reeves Last updated July 11, ; Perpetual-Life Non-Traded REITs: Four Things Investors Should Know · By Matt. A real estate investment trust, or REIT, is a type of trust that invests in a portfolio of real estate. Learn how REITs can provide a way to invest in the. Investors can purchase public non-traded REITs through their financial advisor or on online portals sometimes known as real estate crowdfunding platforms. Real estate investment trusts (REITs) allow you to invest in real estate without owning the properties. · There are two main classes of REIT: equity REITs and. In the broad spectrum of real estate investments, Real Estate Investment Trusts (REITs) are among the most common choices within asset managers' portfolios. Congress created real estate investment trusts (REITs) so that anyone could invest in real estate. The structure leveled the playing field that was once. Indirect ownership (Publicly-traded) Real estate investment trusts (REITs), real estate mutual funds and exchange-traded funds (ETFs) all offer a low-cost. Second, as the REIT raises rents and acquires more investment properties, the REIT can You should contact your Edward. Jones Financial Advisor before acting. Educated REIT Investing is the ultimate resource for investors, financial advisors, and students interested in learning how to invest in real estate investment. The tax law provides a 20% deduction on ordinary REIT dividends. As a result, REIT investors receive higher after-tax income compared to that under the prior. For experienced investors, this structure may not be ideal as they may want more control over major investment decisions. Alternatives to Investing in REITs. A.

Best Bank Overdraft Limit

Additionally, we will only charge Overdraft Fees for a maximum of three overdrafts per day. For all accounts, you will not be charged per-item Overdraft Fees if. Your Overdraft Privilege limit amount will be automatically assigned according to your type of checking account. HOW DOES OVERDRAFT PRIVILEGE WORK? As long as. Automatically transfers funds from your NIHFCU savings to checking at no additional cost to cover your overdrafts, as long as funds are available (limits and. The overdraft limit offered will depend on your financial circumstances when you first apply to open your account. Each bank has its own rules and criteria for. The maximum daily amount of fees the bank will charge you for overdrawing your account is $ These fees may be imposed for covering overdrafts created by. An arranged overdraft lets you borrow up to a certain limit when there's no money left in your bank account. It's useful for short-term borrowing. So as not to exceed the $ limit, please note that the amount of the overdraft plus the bank's standard Non-Sufficient Fund fee of $ (per item) will. As long as your account is in good standing, your current overdraft limit may be available for checks and other transactions made using your checking. Overdraft protection is provided by some banks to customers when their account reaches zero; it avoids insufficient funds charges, but often includes interest. Additionally, we will only charge Overdraft Fees for a maximum of three overdrafts per day. For all accounts, you will not be charged per-item Overdraft Fees if. Your Overdraft Privilege limit amount will be automatically assigned according to your type of checking account. HOW DOES OVERDRAFT PRIVILEGE WORK? As long as. Automatically transfers funds from your NIHFCU savings to checking at no additional cost to cover your overdrafts, as long as funds are available (limits and. The overdraft limit offered will depend on your financial circumstances when you first apply to open your account. Each bank has its own rules and criteria for. The maximum daily amount of fees the bank will charge you for overdrawing your account is $ These fees may be imposed for covering overdrafts created by. An arranged overdraft lets you borrow up to a certain limit when there's no money left in your bank account. It's useful for short-term borrowing. So as not to exceed the $ limit, please note that the amount of the overdraft plus the bank's standard Non-Sufficient Fund fee of $ (per item) will. As long as your account is in good standing, your current overdraft limit may be available for checks and other transactions made using your checking. Overdraft protection is provided by some banks to customers when their account reaches zero; it avoids insufficient funds charges, but often includes interest.

Banks typically charge a NSF fee for each transaction, and these fees too can be costly as they can have ripple effects similar to overdraft fees. It is your. While some banks charge overdraft fees, Capital One does not charge overdraft fees for consumer checking accounts. good standing and/or if you have had too. How a Starling overdraft can help you · Your interest rate · Complete control · No fees · A bit of housekeeping · Gone over the limit? · Financial support · Helping. The Courtesy Pay limit includes any overdraft fees assessed. More Information on Courtesy Pay. If the account has been open and maintained in good standing. Overdraft fees are not applicable to Clear Access BankingSM accounts. The overdraft fee for Wells Fargo Teen CheckingSM accounts is $15 per item and we will. You are required to pay a $36 overdraft fee for each overdraft transaction that is paid by the bank. There is a limit of $ each day in total fees that you. Federal laws do not specify maximum amounts for fees that banks can charge for overdrafts. These decisions are made by the bank. Keep in mind, any withdrawal from a Savings Account counts toward the limit of 10 withdrawals per statement cycle. CoverDraftSM Service. 2. Can you get a cheaper overdraft with an app-based bank? Starling and Monzo* offer overdrafts at 15% and 19% – though only to people. Bank Overdraft Loan · Existing ICICI Bank Current Account customers can avail an instant Overdraft limit of up to Rs 50 lakh · Non ICICI Bank Current Account. We limit daily overdraft charges to 3 overdraft fees per day per account. best to stop any transaction that would overdraw your account. (Just so you. 1. Capital One Checking® Account · 2. Ally Bank Spending Account · 3. Discover® Cashback Debit Account · 4. Axos Bank Rewards Checking · 5. Betterment Checking. We will charge a fee of up to $35 each time we pay an overdraft or return an item for non-sufficient funds. There is a combined daily limit of 4 Overdraft or. Plus, no monthly maintenance fee for SafeBalance Banking® account owners under 25 and this account has no overdraft fees. Ready to open a Bank of America. Best bank accounts for free overdrafts · First Direct 1st Account · TSB Spend & Save Plus · Lloyds Bank Club Lloyds · Nationwide FlexDirect. For consumer accounts, there is a limit of $ Overdraft Item Fees (5) per day we will charge. We will not charge an Overdraft Item Fee if a consumer account. The best way to avoid overdrafts is to Account Details in Mobile and Online Banking would show the $40 check and the $10 overdraft fee for May 1. You can find your courtesy pay limit by logging into online banking or on the dashboard of our mobile app. The limit may change periodically. A maximum of five Overdraft Charges will be assessed per account per day. If your account is overdrawn by less than $, a reduced Overdraft Charge of $ The limit on overdraft fees varies by bank/credit union, but many cap it at four per day. Some banks offer overdraft protection, which can help you avoid fees.

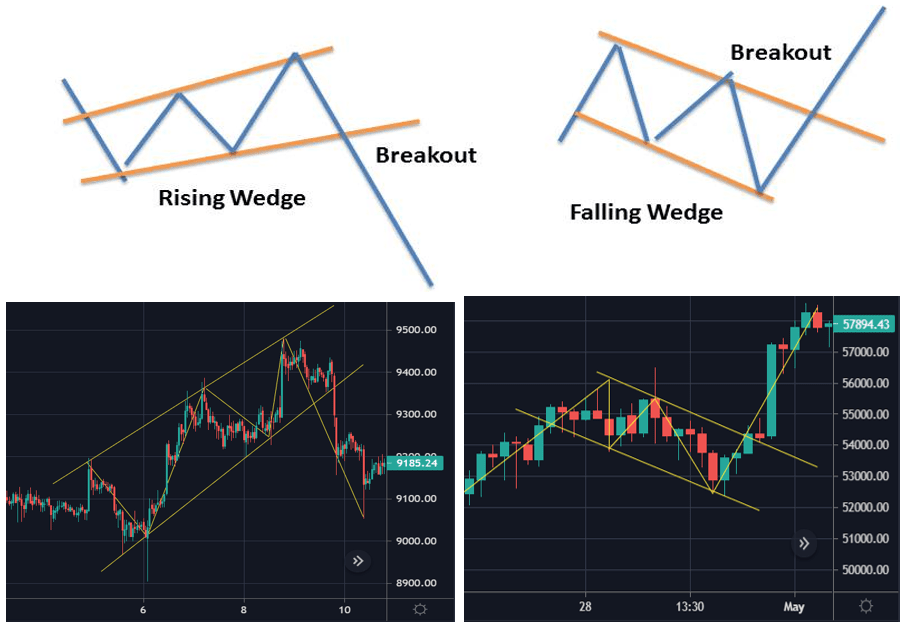

Best Chart For Crypto Trading

Get up to 78% success rates with AI generated crypto chart patterns, a unique tool for traders looking to get involved in crypto trading. altFINS' AI-based. This cryptocurrency trading guide takes a look at a major question often discussed in the cryptocurrency market, "Do Charts & Technical Analysis Really Work. Get a crypto market overview: Bitcoin and altcoin prices, latest news, coin market cap, charts, and much more. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. When you research crypto assets, you may run into a special type of price graph called a candlestick chart. So it's good to take a little time to learn how. 1. TradingView · 2. Altrady · 3. CryptoView · 4. Coinigy · 5. GoCharting · 6. planeta-avto-vostok.ru · 7. Koyfin. Koyfin is like TradingView because. Some of the simple patterns like Support and Resistance breakout and approaches are among the most successful with win rates above 75%. Check out current. Trading View is one of the most popular platforms that offers a range of charting and analysis tools, or indicators, to help traders gain an edge in the. TradingView stands out as the premier tool for creating cryptocurrency charts. Other noteworthy alternatives in the market include CryptoView, Cryptowatch, and. Get up to 78% success rates with AI generated crypto chart patterns, a unique tool for traders looking to get involved in crypto trading. altFINS' AI-based. This cryptocurrency trading guide takes a look at a major question often discussed in the cryptocurrency market, "Do Charts & Technical Analysis Really Work. Get a crypto market overview: Bitcoin and altcoin prices, latest news, coin market cap, charts, and much more. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. When you research crypto assets, you may run into a special type of price graph called a candlestick chart. So it's good to take a little time to learn how. 1. TradingView · 2. Altrady · 3. CryptoView · 4. Coinigy · 5. GoCharting · 6. planeta-avto-vostok.ru · 7. Koyfin. Koyfin is like TradingView because. Some of the simple patterns like Support and Resistance breakout and approaches are among the most successful with win rates above 75%. Check out current. Trading View is one of the most popular platforms that offers a range of charting and analysis tools, or indicators, to help traders gain an edge in the. TradingView stands out as the premier tool for creating cryptocurrency charts. Other noteworthy alternatives in the market include CryptoView, Cryptowatch, and.

Chart analysis in a nutshell Technical analysis is a crucial part of crypto trading. It uses historical price and volume data to forecast market behaviour. How Did Cryptolinks Research Its List of The Best Crypto Chart Websites? ; planeta-avto-vostok.rugview ; planeta-avto-vostok.rurketcap ; planeta-avto-vostok.ruhain. However, the candlestick chart is most frequently used in cryptocurrency market analysis, as is the case in forex and commodity market analyses. The technical. The most common and professional ones are Japanese candlesticks, which are drawn to analyze the price action which tells a lot about the trading of a certain. Mastering both single-candle and multi-candle chart patterns is vital for successful cryptocurrency trading. These patterns, along with additional technical. The candlestick chart is a more advanced trading tool containing additional useful information. It is popular among crypto traders for use in technical analysis. Detecting and trading reversal patterns are some of the best ways to make There are two main trading patterns in day trading – crypto reversal patterns. The Individual Parts of a Crypto Token Chart · Trading Pair: Indicates the base currency (BTC) and the quote currency (USDT) being used in this particular market. Candlestick charts have become the most recognizable crypto charting method. As a staple in the industry now, crypto traders can work with – and even create –. Since then, we built Cryptowatch into a leading charting and trading platform for cryptocurrency markets. best Cryptowatch technology into Kraken products. Top 10 Crypto Trading Indicators for · 1. Moving Averages · 2. Relative Strength Index (RSI) · 3. Bollinger Bands · 4. On-Balance-Volume (OBV) · 5. Ichimoku. Comprehensive and easy-to-use live cryptocurrency chart that tracks the movements of hundreds of cryptocurrencies planeta-avto-vostok.ru is better on the app. Open. planeta-avto-vostok.ru This has to be the best for monitoring BTC on all exchanges with alarms for prices and charting. Top cryptocurrency prices and charts, listed by market capitalization. Free access to current and historic data for Bitcoin and thousands of altcoins. Simple for beginners and effective for technical analysis experts, TradingView has all of the instruments for publication and the viewing of trading ideas. This blog post will walk you through how to visualize your Cryptocurrencies' price action data to forecast bullish and bearish opportunities. CCData provides weekly data-driven insights and analysis into the latest cryptocurrency market trends and narratives. Bitcoin is the world's most traded cryptocurrency, and represents the largest piece of the crypto market pie. Updated: March altFINS' automated chart pattern recognition engine identifies 16 trading patterns across multiple time intervals, saving traders a ton. The ideal timeframe for crypto day trading, in general, is a ratio of or , like for entries in an hour chart and for finding the trend

Does Excedrin Migraine Help With Toothache

Several medications can treat and prevent migraines. Many of the initial go-to treatment choices are OTC medications like Excedrin Migraine and Advil Migraine. It relieves minor aches and pains due to headache, cold, arthritis, muscular aches, toothache and more. Excedrin Extra Strength's combination of active. Helps Relieves Headache, Toothache, Backache, Menstrual Cramps, Common Cold, and Muscular Aches. Tylenol Extra Strength Rapid Release Gels can be used to help treat minor aches and pains related to headache, backache, minor arthritis pain, toothaches, pain. Ibuprofen is suffucient and works well for toothache. Excedrin is a little too much, but still be taken for the same. The best option is to get. NDC - EXCEDRIN® TENSION HEADACHE - Acetaminophen and Caffeine - Pain Reliever / Pain Reliever Aid - Aspirin Free - 24 CAPLETS - TAMPER-EVIDENT. Acetaminophen, aspirin, and caffeine is a combination medicine used to treat pain caused by tension headaches, migraine headaches, muscle aches, menstrual. EXCEDRIN® EXTRA - STRENGTH - Acetaminophen, Aspirin (NSAID) and Caffeine - Pain Reliever / Pain Reliever Aid - 6 Caplets - 3 PACKETS OF 2 CAPLETS - Lil' Drug. Shop excedrin toothache pain at Walgreens. Find excedrin toothache pain coupons and weekly deals. Pickup & Same Day Delivery available on most store items. Several medications can treat and prevent migraines. Many of the initial go-to treatment choices are OTC medications like Excedrin Migraine and Advil Migraine. It relieves minor aches and pains due to headache, cold, arthritis, muscular aches, toothache and more. Excedrin Extra Strength's combination of active. Helps Relieves Headache, Toothache, Backache, Menstrual Cramps, Common Cold, and Muscular Aches. Tylenol Extra Strength Rapid Release Gels can be used to help treat minor aches and pains related to headache, backache, minor arthritis pain, toothaches, pain. Ibuprofen is suffucient and works well for toothache. Excedrin is a little too much, but still be taken for the same. The best option is to get. NDC - EXCEDRIN® TENSION HEADACHE - Acetaminophen and Caffeine - Pain Reliever / Pain Reliever Aid - Aspirin Free - 24 CAPLETS - TAMPER-EVIDENT. Acetaminophen, aspirin, and caffeine is a combination medicine used to treat pain caused by tension headaches, migraine headaches, muscle aches, menstrual. EXCEDRIN® EXTRA - STRENGTH - Acetaminophen, Aspirin (NSAID) and Caffeine - Pain Reliever / Pain Reliever Aid - 6 Caplets - 3 PACKETS OF 2 CAPLETS - Lil' Drug. Shop excedrin toothache pain at Walgreens. Find excedrin toothache pain coupons and weekly deals. Pickup & Same Day Delivery available on most store items.

Excedrin drug is a combination of many drug groups together including Aspirin, Acetaminophen and Caffeine, with temporary pain relief in diseases such as. FAST. TRUSTED. RELIEF. Excedrin Extra Strength's combination of ingredients delivers a fast-acting non-prescription headache pain reliever. It relieves minor. Compare active ingredient to Excedrin®. LOADING IMAGES. Product Information. For extra strength relief from the pain of headache, toothache, muscle aches and. Temporarily relieves minor aches and pains due to: headache, a cold, arthritis, muscular aches, toothache, premenstrual and menstrual cramps · Treats migraine. Excedrin Migraine treats migraines. But Excedrin Extra Strength is labeled to help with minor aches and pains, including headaches and muscle aches. Excedrin Migraine treats migraines. But Excedrin Extra Strength is labeled to help with minor aches and pains, including headaches and muscle aches. Excedrin Extra Strength Pain Relief Caplets are pain relievers that provide clinically proven, fast acting headache relief. Excedrin Extra Strength is used to help relieve minor aches and pains associated with a headache, cold, arthritis, muscle ache, toothache, or. Excedrin Extra Strength Pain Relief Caplets are pain relievers that provide clinically proven, fast acting headache relief. For some, headache pain relief with this Excedrin extra strength pain reliever can start in 15 minutes. Get headache relief fast with Excedrin, the headache. Excedrin Migraine provides migraine relief, while Excedrin Extra Strength can temporarily relieve toothache, and premenstrual and menstrual cramps. Why does Excedrin contain caffeine? Caffeine has been found to enhance the pain-relieving function of aspirin and acetaminophen when used in combination as in. When you have a toothache, an over-the-counter pain reliever such as ibuprofen or acetaminophen can help ease discomfort (but never put aspirin against the gums. menstrual cramps, arthritis, tooth pain and muscle pain. For some, headache pain relief with this Excedrin extra strength pain reliever can start in 15 minutes. You can help prevent an upset stomach if you take the medicine with food. • Do not drink alcohol when you are taking these medicines. • Some people cannot take. These medicines may help with arthritis, colds, headache (including migraine), muscle aches, menstrual cramps, sinusitis and toothache. These drugs are. How do you want your item? · Excedrin Extra Strength Pain Relief Caplets for Headache Relief, Temporarily Relieves Minor Aches and Pains Due to Headache – Excedrin is pretty much the only thing that helps with my headaches. I carry it everywhere I go because I do not want to be without it. As far as headache. Excedrin Extra Strength can help you temporarily relieve minor aches and pains due to headache, a cold, arthritis, muscular aches, toothache, premenstrual and. Temporarily relieves minor aches and pains due to: headache, a cold, arthritis, muscular aches, toothache, premenstrual and menstrual cramps. ○ Excedrin Extra.

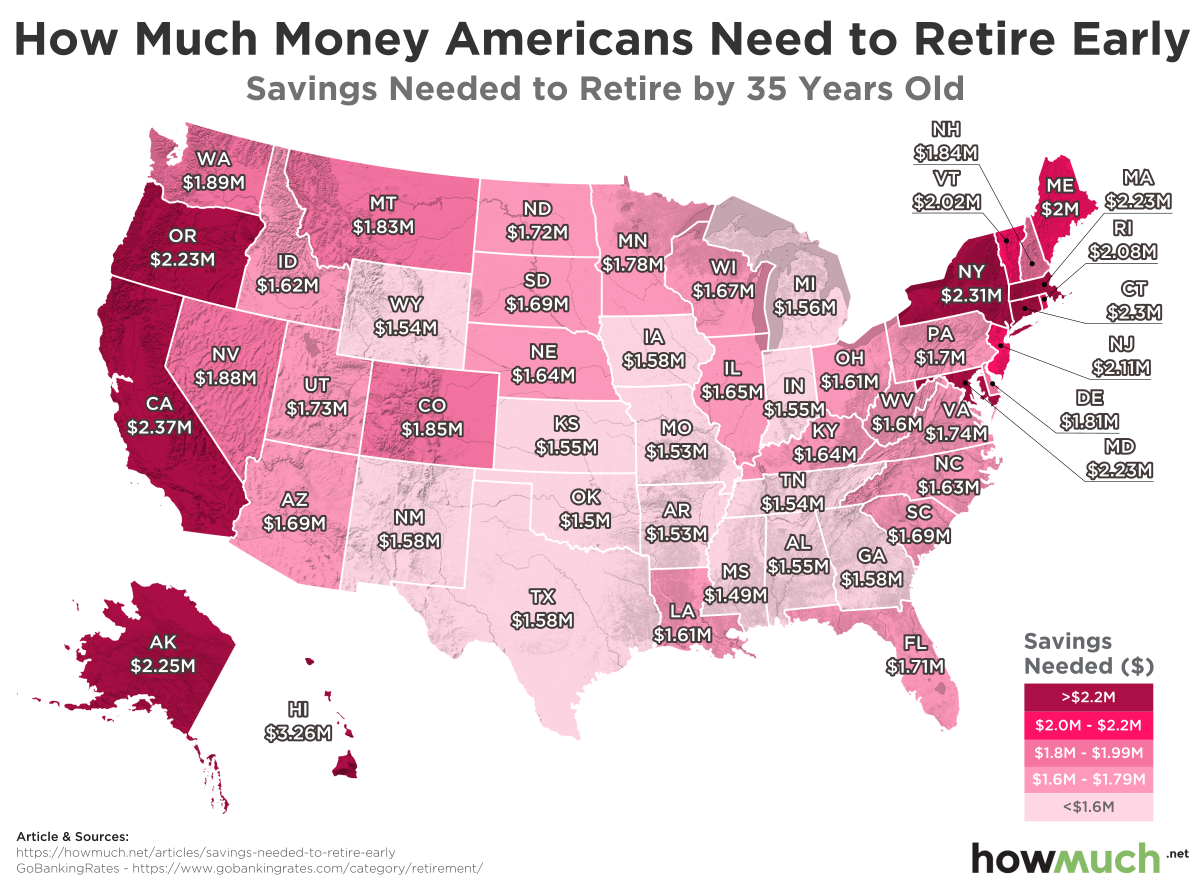

How Much Is Needed To Retire At 55

Someone between the ages of 51 and 55 should have times their current salary saved for retirement. Someone between the ages of 56 and 60 should have Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at How Much Do I Need to Retire at 55? To retire at 55, estimate your annual expenses and ensure your savings can cover them until Social Security starts at Retire at 55 With $ Million? appeared first on SmartAsset Blog “Their retirement money is in that account, too.” They probably want the. Someone between the ages of 51 and 55 should have times their current salary saved for retirement. Someone between the ages of 56 and 60 should have If you are planning on retiring in your 50s or early 60s, you will need a substantial pension pot to sustain you over the next years. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. Many financial advisors suggest saving 10% to 15% of your gross income, starting in your 20s That's in addition to money set aside for short-term goals, such. How much money do you need to retire? A good rule of thumb is to save enough to cover 80% of your pre-retirement income. planeta-avto-vostok.ru Someone between the ages of 51 and 55 should have times their current salary saved for retirement. Someone between the ages of 56 and 60 should have Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at How Much Do I Need to Retire at 55? To retire at 55, estimate your annual expenses and ensure your savings can cover them until Social Security starts at Retire at 55 With $ Million? appeared first on SmartAsset Blog “Their retirement money is in that account, too.” They probably want the. Someone between the ages of 51 and 55 should have times their current salary saved for retirement. Someone between the ages of 56 and 60 should have If you are planning on retiring in your 50s or early 60s, you will need a substantial pension pot to sustain you over the next years. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. Many financial advisors suggest saving 10% to 15% of your gross income, starting in your 20s That's in addition to money set aside for short-term goals, such. How much money do you need to retire? A good rule of thumb is to save enough to cover 80% of your pre-retirement income. planeta-avto-vostok.ru

Generally, experts suggest aiming for a retirement income of about % of your pre-retirement salary. For instance, if you and your spouse plan to retire at. If you are planning on retiring in your 50s or early 60s, you will need a substantial pension pot to sustain you over the next years. The rule of thumb is to religiously save and invest 15% of your gross income if you want to retire at around If you want to retire sooner. How Much Do I Need to Retire at 55? To retire at 55, estimate your annual expenses and ensure your savings can cover them until Social Security starts at Someone between the ages of 51 and 55 should have times their current salary saved for retirement. Someone between the ages of 56 and 60 should have Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. A common way to estimate how much income you'll need in retirement is to use the '70 per cent rule'. This says that you will need 70 per cent of your working. Generally speaking, experts advise having 80% to 90% of your annual pre-retirement income saved for each year of early retirement. You can estimate the sum you. A common rule of thumb is the “25 times rule,” suggesting you need 25 times your annual expenses to retire comfortably. If you spend $40, a year, aim for $1. How much does a single person need to retire in the UK? · £14, per year for a minimum retirement · £31, per year for a moderate retirement · £43, per year. Your current savings plan, including Social Security benefits will provide the equivalent of $76, a year in retirement income. We project you will need. How much money do you need to retire at 55? If you plan to retire at 55, a general rule of thumb is to save around 25 times your expected annual expenses. This. What is a Good Pension Pot at 55? The amount of money you should have in your pension pot to retire at 55 will depend on your personal circumstances. Most. Our retirement calculator estimates your savings based on your current contributions and then calculates how that money will stretch in today's dollars. Using a withdrawal rate of 4%, you should have a minimum of $1 million in retirement savings before you retire. ⇒ $40, ⁄ 4% = $1,, Money market accounts are similar to savings accounts, but offer some checking features as well. How does an MMA work? Unlock financial rewards by signing. Assuming a 6% after tax return, if our retiree has $ million in savings and investments at age 60 — $1 million short of what she needs to retire on at that. Whether $2 million is enough for a couple to retire at 60 largely depends on their desired lifestyle and how much it costs. It's crucial to calculate the. To retire at 55, how much do you need, and what do you need to know? See how to plan for an early retirement. To get a ballpark figure of how much you'll need, start by estimating your expected income by age Depending on the type of retirement you want, multiply.

2 3 4 5 6 7