planeta-avto-vostok.ru Overview

Overview

Pay Loan Early

You can repay your loan early and start a new application once we have received and processed your payment, except in Alberta, Nova Scotia, and Manitoba. When you enroll, you can choose to pay the Current Amount Due, which is the amount required to be paid each month until the loan is paid in full, or you could. You have two options to pay your loan in full. You can visit a branch or call us at You can do so at any time, without penalty. One of the main advantages of early loan repayment is that you will spend less on interest charges. If you pay the balance of your loan early, then you will. Yes. There is never a fee for making prepayments or paying your loan off early. To pay off your loan or to see what your payoff amount is. Tips to pay off mortgage early · 1. Refinance your mortgage · 2. Make extra mortgage payments · 3. Make one extra mortgage payment each year · 4. Round up your. Yes. You will owe any accrued interest from the day the loan originates until the day you pay it off. Usually with car loans there are no. Almost every type of loan can be paid off early, and there are many benefits for doing so. It can save you money. It can improve your credit score (though not. Saving Money on Interest. The best reason to pay off loans and other debts early is that it can save you money in interest payments. The only advantage of. You can repay your loan early and start a new application once we have received and processed your payment, except in Alberta, Nova Scotia, and Manitoba. When you enroll, you can choose to pay the Current Amount Due, which is the amount required to be paid each month until the loan is paid in full, or you could. You have two options to pay your loan in full. You can visit a branch or call us at You can do so at any time, without penalty. One of the main advantages of early loan repayment is that you will spend less on interest charges. If you pay the balance of your loan early, then you will. Yes. There is never a fee for making prepayments or paying your loan off early. To pay off your loan or to see what your payoff amount is. Tips to pay off mortgage early · 1. Refinance your mortgage · 2. Make extra mortgage payments · 3. Make one extra mortgage payment each year · 4. Round up your. Yes. You will owe any accrued interest from the day the loan originates until the day you pay it off. Usually with car loans there are no. Almost every type of loan can be paid off early, and there are many benefits for doing so. It can save you money. It can improve your credit score (though not. Saving Money on Interest. The best reason to pay off loans and other debts early is that it can save you money in interest payments. The only advantage of.

One of the main advantages of early loan repayment is that you will spend less on interest charges. If you pay the balance of your loan early, then you will. You could be penalized. If your loan is subject to prepayment penalties, you'll be charged a fee if you pay it off early. Not all loans come with prepayment. When Does Paying Off a Car Loan Early Makes Sense? · You won't face any prepayment penalties, or the total cost of those penalties is less than what you'd. You can absolutely pay your car loan off early if you wish. Learn the various ways you can work toward accomplishing an early auto loan payoff with the. There are no penalties for paying back a loan early, but you will still be charged a fee if you make early repayments. These fees can be high, which might deter. There are no penalties or fees for paying early. You may even save money on interest by choosing to pay off your loan early. Paying more than your monthly. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. Paying off a personal loan early can save you on interest, but pause to make sure the pros outweigh the cons before you proceed. In addition, there are no pre-payment penalties if you decide to pay your Personal Loan off early. We will charge a $39 fee for any month that we receive your. Paying off a loan early usually won't tank your credit, but it might drop your score a bit. I've been there—paid off a personal loan early and. Key Takeaways · Paying off a loan may lower your credit score, but if you practice good credit habits the effect will be minimal. · Paying off a loan early can. As for what you can do, it's a simple interest loan so you only pay for the interest you use. If you paid it off today you'd pay roughly $1, Learn can if I can replay my loan early. It's important to remember that if you repay your loan early, you will be charged an Early Repayment Fee. The amount you will be charged will be equal to Yes! You can pay off your car loan early but there may be some instances where it doesn't make sense. Learn more with Toyota of Cedar Park! Your proposed extra payment per month. This payment will be used to reduce your principal balance. Current payment. Monthly principal and interest payment based. How to Pay Off a Car Loan Early · Make Bi-Weekly Payments - Make sure your lender allows this. · Round Up Your Payment Each Month - With every monthly payment. Review your loan agreement, which is the contract between you and the bank, to determine if it specifies the circumstances that could result in a prepayment. If you wish to pay your loan off early, Santander does not charge an early payment penalty. Can I pay off my loan early? Yes, you can pay off a personal loan. Apply extra to the principal to pay off student loans fast. Remember that the interest on federal student loans accrues, or builds up, on a daily basis. So.

Cheap Motorcycle Insurance California

Get Affordable Motorcycle Insurance in California. Pronto Insurance offers robust and flexible motorcycle insurance options. Each insurance package includes. Get the right motorcycle insurance, on and off the road. Find your local independent agent to help you customize your coverage. We provide affordable motorcycle insurance in California and have one of the highest customer satisfaction rates with multiple 5-star reviews. Is low cost insurance available? If you cannot afford liability insurance, you may be eligible for the California Low Cost Automobile Insurance Program. Cheap motorcycle insurance is quick and easy with Insurance Navy - great Motorcycle insurance rates with the best coverage. Get a free personalized. See how GEICO not only provides affordable motorcycle insurance with multiple discounts, but also provides great motorcycle insurance coverage. Get a quick and complimentary online quote for motorcycle insurance and discover potential savings on coverage for your bike with GEICO! GEICO offers the cheapest full coverage and liability-only packages in the state. For full coverage, the rate is $ annually. The company's liability-only. Motorcycle insurance can help protect you and your motorcycle. Get a fast and free motorcycle insurance quote to explore your options with Allstate. Get Affordable Motorcycle Insurance in California. Pronto Insurance offers robust and flexible motorcycle insurance options. Each insurance package includes. Get the right motorcycle insurance, on and off the road. Find your local independent agent to help you customize your coverage. We provide affordable motorcycle insurance in California and have one of the highest customer satisfaction rates with multiple 5-star reviews. Is low cost insurance available? If you cannot afford liability insurance, you may be eligible for the California Low Cost Automobile Insurance Program. Cheap motorcycle insurance is quick and easy with Insurance Navy - great Motorcycle insurance rates with the best coverage. Get a free personalized. See how GEICO not only provides affordable motorcycle insurance with multiple discounts, but also provides great motorcycle insurance coverage. Get a quick and complimentary online quote for motorcycle insurance and discover potential savings on coverage for your bike with GEICO! GEICO offers the cheapest full coverage and liability-only packages in the state. For full coverage, the rate is $ annually. The company's liability-only. Motorcycle insurance can help protect you and your motorcycle. Get a fast and free motorcycle insurance quote to explore your options with Allstate.

Protect your ride with affordable motorcycle insurance. We insure teachers, police officers, firefighters, and registered nurses. What are the cheapest motorcycle insurance companies in California city to city ; Minimum Coverage, San Francisco, CA, $18/month, $86/month, $57/month ; Upgraded. Because people who have completed a motorcycle safety course are less likely to be involved in an accident, most insurance companies offer discounts to these. We'll list the cheapest motorcycle insurance quotes available, based on your zip code. Click on the insurance carrier that you would like a see the quote. Looking for cheap motorcycle insurance? Freeway Insurance can find you great rates on motorcycle insurance or scooter insurance coverage. Affordable Insurance Coverage from the name you trust. Harley-Davidson® Insurance California Finance Lenders Law license. **See TERMS for details. Plus. Start saving with VOOM's usage based insurance. by switching to VOOM Insurance, Rideshare, Delivery drivers and motorcycle riders can save up to 60%. Get motorcycle insurance for all brands from a company that knows motorcycles. Insurance policies as low as $6/month. Get a quote in minutes! Best Motorcycle Insurance in California · The General Insurance · Direct Auto Insurance · National General Insurance · Esurance · MAPFRE Insurance · Nationwide. If you're an experienced rider, you may pay around an average cost of $ per year for motorcycle insurance, but the price can vary if you live in San. Get a California motorcycle insurance quote in minutes. Click the button above to start a quote online, speak with a local agent or call Get a free Dairyland® quote for California motorcycle insurance. Dairyland—trusted by bikers for more than 50 years. Fast, free quotes available online or. Progressive's discounts make motorcycle insurance affordable for all · Affordability. Progressive offers customized coverage without putting a dent in your. E offers affordable and premier motorcycle insurance in CA. Covering theft, liability, and medical costs for secure journeys. No doubt, a lot of the best insurance companies provide cheap motorcycle insurance California. But the Kardar Insurance Agency offers an affordable. Affordable motorcycle insurance, customized for you. Your motorcycle is more than just a way to get from point A to point B. Voom keeps it simple. If you ride less, you should pay less. Save with pay per mile motorcycle insurance and get a free, no-obligation quote with Voom today. If you're looking for cheap motorcycle insurance, our discounts deliver. LegalCalifornia LicensingTerms and ConditionsPrivacyCustomer NotificationsWeb. Insure your bike with Saferoad's low-cost motorcycle insurance. You can find our renowned agency professionals in Los Angeles, Long Beach, and Anaheim. California Motorcycle Museum · Careers Harley-Davidson® Insurance is quality, affordable motorcycle insurance, backed by quality service and support.

Walmart Takes Ebt

You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana. Louisiana WIC (LA WIC) is partnering with WIC. Authorized Walmart stores in Louisiana to offer the use of LA WIC EBT cards at self-checkout lanes. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. Walmart accepts EBT card purchases at all locations that sell food and grocery items. Your EBT card can be used the same way you would use your debit card. Walmart stores also accept SNAP benefits. Does Walmart accept both EBT SNAP & EBT Cash for online transactions? Yes, Walmart accepts both EBT SNAP & EBT. What is an EBT card? · Can I use EBT SNAP for grocery delivery or pickup orders on Instacart? · Does Instacart accept SNAP benefits? · Which stores accept EBT SNAP. Walmart accepts several payment methods such as the following: EBT cards from participating states for the purchase of EBT eligible items; Debit cards; Credit. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. Shop for EBT eligible items in Meat & Seafood. Buy products such as Beef Choice Angus Sirloin Tender Steak, - lb Tray at Walmart and save. You can pay for Walmart online grocery with EBT in all but five states. These states are Arkansas, Alaska, Louisiana, Maine, and Montana. Louisiana WIC (LA WIC) is partnering with WIC. Authorized Walmart stores in Louisiana to offer the use of LA WIC EBT cards at self-checkout lanes. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. Walmart accepts EBT card purchases at all locations that sell food and grocery items. Your EBT card can be used the same way you would use your debit card. Walmart stores also accept SNAP benefits. Does Walmart accept both EBT SNAP & EBT Cash for online transactions? Yes, Walmart accepts both EBT SNAP & EBT. What is an EBT card? · Can I use EBT SNAP for grocery delivery or pickup orders on Instacart? · Does Instacart accept SNAP benefits? · Which stores accept EBT SNAP. Walmart accepts several payment methods such as the following: EBT cards from participating states for the purchase of EBT eligible items; Debit cards; Credit. Participating online stores now accept SNAP benefits for online orders and will deliver to you. Use your EBT card to shop securely for fresh produce and. Shop for EBT eligible items in Meat & Seafood. Buy products such as Beef Choice Angus Sirloin Tender Steak, - lb Tray at Walmart and save.

If you have Cash Benefits available on your EBT Card, you can you use those benefits to make food or other purchase at Walmart. What stores will take by EBT. Currently, Albertsons, Amazon, Safeway, Vons, and Walmart are the only retailers that accept EBT cards online in California. CDSS is working hard to add more. Watch this page for updated information. How can retailers add SNAP EBT to their retailer web site? All retailers, including internet retailers, must abide by. SNAP/EBT*. Healthy Benefits+ (S3 Network)**. Walmart Credit (PLCC) Sam's Club gas stations do accept Walmart Credit Cards. Related Articles. How. Online there can be sellers that aren't Walmart. Those sellers don't take ebt. Same as with Amazon. Amazon itself will take ebt for food but. They used to allow customers to purchase herbal tea with their EBT cards, but now they banned it. Can they do this? If so, why? Additionally, EBT cardholders are able to use their benefit cards for online purchasing at Safeway, Amazon, Walmart, and more. For additional information. Walmart, as well as ALDI, Big Y, Brothers Marketplace, Hannaford, McKinnon's Apply for SNAP benefits (food stamps) Welcome to EBT. Materials & FAQ. No links allowed except for Admin links. Admin will post links in the title or in the comments of any posts for Amazon, Walmart and Target relevant to any items. Download the ebtEDGE mobile app to view locations near you that accept Summer EBT benefits. Walmart: Accepts EBT payment during checkout and offers pickup. Shop for EBT eligible items in Meat & Seafood. Buy products such as Beef Choice Angus Sirloin Tender Steak, - lb Tray at Walmart and save. What stores will accept my EBT card online? Currently, you can use your SNAP EBT benefit to make purchases online at. Walmart and Amazon. You can also use. What stores will take my EBT card online? Currently, you can use your EBT card to make purchases online at Walmart and Amazon. If you get CalFresh food benefits. Walmart is one of many retailers that accepts EBT payments (in 48 states you If you've just started up with SNAP and are wondering, “What can I buy with EBT. 3) Swipe EBT card with the Walmart associate upon arrival at the pick-up Some stores accept EBT cards for home delivery and/or curbside pick-up. See if you qualify quickly using our secure verification process. [LD] WalmartPlus. Choose your discounted plan. Select either a monthly or an annual plan—. Use your EBT card to shop securely for fresh produce and groceries at these participating stores in the Maryland area: Amazon, ShopRite, Walmart, Food Lion. EBT card. Groceries can be purchased for home delivery using your EBT card at Amazon and Walmart (note that CalFresh does not cover the delivery fee). Home. Walmart online accepts EBT Cash for payments. You can use EBT cash to cover It only takes a couple of minutes to see if you qualify for this free service. Walmart is one of many retailers that accepts EBT payments (in 48 states you If you've just started up with SNAP and are wondering, “What can I buy with EBT.

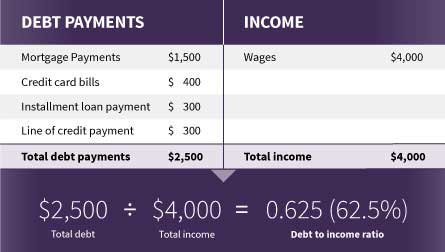

Debt To Income Ratio For Buying A House

The front-end debt-to-income ratio looks only at your housing payments. If you don't currently own a house, the lender looks at the proposed payments for the. In addition to your credit score, your debt-to-income (DTI) ratios are looked at by closely by mortgage lenders when you apply for a loan. This ratio is. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28%–35% of that debt going toward servicing a mortgage.1 The maximum DTI ratio. While there are guidelines that many lenders follow, DTI requirements can vary by lender, and more specifically, by loan type. Although conventional mortgage. Debt to income ratios are a crucial part of the loan process. Find out what's included in DTI ratios, how it is calculated and answers to other common. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. Most lenders go by the 28/36 rule - mortgage payment no more than 28% of gross income and total debt obligations no more than 36%. You can. It is the percentage of your monthly pre-tax income you must spend on your monthly debt payments plus the projected payment on the new home loan. A debt-to-income ratio of 20% means that 20% of your income is going toward debt payments. This includes cumulative debt payments, so think credit card payments. The front-end debt-to-income ratio looks only at your housing payments. If you don't currently own a house, the lender looks at the proposed payments for the. In addition to your credit score, your debt-to-income (DTI) ratios are looked at by closely by mortgage lenders when you apply for a loan. This ratio is. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28%–35% of that debt going toward servicing a mortgage.1 The maximum DTI ratio. While there are guidelines that many lenders follow, DTI requirements can vary by lender, and more specifically, by loan type. Although conventional mortgage. Debt to income ratios are a crucial part of the loan process. Find out what's included in DTI ratios, how it is calculated and answers to other common. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. Most lenders go by the 28/36 rule - mortgage payment no more than 28% of gross income and total debt obligations no more than 36%. You can. It is the percentage of your monthly pre-tax income you must spend on your monthly debt payments plus the projected payment on the new home loan. A debt-to-income ratio of 20% means that 20% of your income is going toward debt payments. This includes cumulative debt payments, so think credit card payments.

Your debt-to-income ratio is calculated by adding up all your monthly debt payments and dividing them by your gross monthly income. AgSouth Mortgages Home Loan Originator Brandt Stone says, “Typically, conventional home loan programs prefer a debt to income ratio of 45% or less but it's not. To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2, per month and your monthly. How to Calculate Debt-to-Income Ratio · Step 1: Add up all the minimum payments you make toward debt in an average month plus your mortgage (or rent) payment. Lenders typically say the ideal front-end ratio should be no more than 28 percent, and the back-end ratio, including all expenses, should be 36 percent or lower. Most conventional loan underwriting conditions limit DTI to 45%, but some QM lenders will accept ratios up to 50% if the borrower has compensating factors, such. Most loan programs allow for a Total DTI of 43% and a Housing DTI of 31%. Two Types of DTI Ratios: a) Front End or Housing Ratio: Should be % of your gross. Typical co-op buyer financial requirements in NYC include 20% down, a debt-to-income ratio between 25% to 35% and 1 to 2 years of post-closing liquidity. Debt-. Maximum Debt-to-Income Ratio Requirements ; FHA loan [2], 31%, or 40% if the borrower has a credit score of at least and meets certain conditions, 43%, or This is seen as a wise target because it's the maximum debt-to-income ratio at which you're eligible for a Qualified Mortgage —a type of home loan designed to. You can calculate your front-end-ratio by dividing your total anticipated monthly housing costs by your monthly gross income and multiplying by What is. Lenders prefer a 36% DTI — the more breathing room you have at the end of the month, the easier it is to withstand changes to your expenses and income. Front-end debt ratio, sometimes called mortgage-to-income ratio in the context of home-buying, is computed by dividing total monthly housing costs by monthly. High LTV refinance loans: For loans underwritten in accordance with the Alternative Qualification Path, if the recalculated DTI ratio exceeds 45%, the loan is. The DTI ratio requirement is 41%. USDA loan. To purchase a home with a USDA loan, the home must be in an eligible rural area as defined by USDA United States. As a general rule of thumb, it's best to have a debt-to-income ratio of no more than 43% — typically, though, a “good” DTI ratio is below 35%. On USDA loans, also sometimes called rural housing loans, the DTI requirements are 29% on the front end and 41% on the back end. The CFPB shows that 36% is the. For FHA and VA loans, the DTI ratio limits are generally higher than those for conventional mortgages. For example, lenders may allow a DTI ratio of up to 55%. A lender will want your total debt-to-income ratio to be 43% or less, so it's important to ensure you meet this criterion in order to qualify for a mortgage. FHA loans are less strict, requiring a 31/43 ratio. For these ratios, the first number is the percentage of your gross monthly income that can go toward housing.

Best Cd Rates Okc

We offer a variety of CD terms to help build your nest egg, whether you're just starting out or ready to retire. Our IRA helps you jump-start your retirement. When it comes to CD rates, we have some of the best around. %. Top Local Branch Rates ; %. The State Exchange BankHigh Yield Savings Via Raisin · %. MidFirst Bank ; %. First Oklahoma BankHigh Yield Online Checking. Oklahoma Mortgage and Refinance Rates ; Citizens Bank, NA. 30 year fixed. Points: %. 30 year fixed. % ; Bank of America. 30 year fixed. Points. Our Certificates of Deposit let you choose the terms, from 91 days to 5 years, with fixed interest rates based upon the rate at the time of purchase. Certificate Rates ; Certificates, $1,, %, %, 48 ; Certificates, $50,, %, %, Day. BancFirst. Childrens Ave Oklahoma City, OK % ; Bank of the West. Gaillardia Pkwy Oklahoma City, OK % ; Chickasaw Community Bank. Compare Rates ; 6-month CD. % APY ; 1-year cd. % APY ; 2-year cd. % APY ; 5-year cd. % APY. Certificates of Deposit & IRAs ; 6 Months, %, % ; 9 Months (CD only), %, % ; 12 Months, %, % ; 18 Months, %, %. We offer a variety of CD terms to help build your nest egg, whether you're just starting out or ready to retire. Our IRA helps you jump-start your retirement. When it comes to CD rates, we have some of the best around. %. Top Local Branch Rates ; %. The State Exchange BankHigh Yield Savings Via Raisin · %. MidFirst Bank ; %. First Oklahoma BankHigh Yield Online Checking. Oklahoma Mortgage and Refinance Rates ; Citizens Bank, NA. 30 year fixed. Points: %. 30 year fixed. % ; Bank of America. 30 year fixed. Points. Our Certificates of Deposit let you choose the terms, from 91 days to 5 years, with fixed interest rates based upon the rate at the time of purchase. Certificate Rates ; Certificates, $1,, %, %, 48 ; Certificates, $50,, %, %, Day. BancFirst. Childrens Ave Oklahoma City, OK % ; Bank of the West. Gaillardia Pkwy Oklahoma City, OK % ; Chickasaw Community Bank. Compare Rates ; 6-month CD. % APY ; 1-year cd. % APY ; 2-year cd. % APY ; 5-year cd. % APY. Certificates of Deposit & IRAs ; 6 Months, %, % ; 9 Months (CD only), %, % ; 12 Months, %, % ; 18 Months, %, %.

Certificate of Deposit accounts offer fixed interest rates for a set term length. CDs are short-term investments that provide the security of guaranteed. Summary of best 1-year CD rates. Our list features banks and credit unions that NerdWallet has reviewed with nationally available one-year CD rates. Regular CD. The best month CD rate is % APY from Connexus Credit Union. The minimum deposit requirement to open this month CD is $5, CD rates are near. Compare the top CD rates from local and national financial institutions for Oklahoma (OK), Oregon (OR), Pennsylvania (PA), Rhode Island (RI), South. Certificate of Deposit Rates ; 6 Mo. · % ; 12 Mo. · % ; 18 Mo. · % ; 24 Mo. · % ; 30 Mo. · %. LOANS MORTGAGES SAVINGS CERTIFICATES Today's Rates Our rates change by the day, so be sure to check in as frequently as possible. Finding the Best CD Rates ; Capital One logo Capital One, %, $0 ; Highlights. Best 1-Year CD account with no minimum; APY as of 8/7/24; Variety of CDs. See our current rates · Apply for a Certificate of Deposit account. Individual Retirement Account (IRA). Get your retirement in order with a Traditional or Roth. Guaranteed rates and peace of mind. Our competitive certificates offer rates to help you grow your savings faster. Certificates. African. High rate CDs up to % with flexible terms, including no penalty CD and no maintenance fee. Vast Bank is a 40+ year financial institution based in Tulsa. Oklahoma Fixed Rate CD and IRA Rates ; 12 Month, $1,, % ; 18 Month, $1,, % ; 24 Month, $1,, % ; 30 Month, $5,, %. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. Quontic Bank is an online bank that offers CDs as well as savings, money market and checking accounts. A $ minimum deposit is required to open a Quontic Bank. The Best Oklahoma Certificate of Deposit (CD) Rates [Updated: December ] ; 5-Year CD Rate, BMO Alto, %, $1, 5-Year Annuity Rate ; 3-Year CD Rate. Frontier State Bank has some of the highest rates in the area for Certificates of Deposit! CDs are a great way to earn a higher interest rate on funds you don'. With a Certificate of Deposit from BancFirst in Oklahoma, you can choose your own savings plan. Explore our great CD rates and open an account today. Oklahoma Mortgage and Refinance Rates ; Citizens Bank, NA. 30 year fixed. Points: %. 30 year fixed. % ; Bank of America. 30 year fixed. Points. Certificates of Deposit* ; 12 month, $, %, %, CD ; 18 month, $, %, %, CD. Bask Bank is a good option if you'd like to earn a competitive interest rate on an month CD. Several of Bask Bank's short-term CDs offer great rates, so if. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum.

Putting Car Loan On Mortgage

:max_bytes(150000):strip_icc()/approved-car-loan-application-98570101-5b800241c9e77c0050572c53.jpg)

You are using money you've already paid on your mortgage, and home equity loans can have very low monthly payments in comparison to auto loans. That's. Different lenders charge auto loan interest rates depending on market demand, your creditworthiness, how much you're borrowing compared to the vehicle's value . Generally no you cannot. When purchasing a home the mortgage is issued a bit backwards from refinancing. The loan looks at the sales price and. Robins Financial has no pre-payment penalties on our auto loans. Missing Payments. Stay on top of the entire refinance process, and don't assume anything is a. Apply for an Auto Loan today Qualifying loans include mortgage, home equity, auto, and credit card. A qualifying loan must have a current balance and. You could ask the lender if you can put extra money on the auto loan when it fits your budget. This can help you to pay less back, overall—and, at SCCU, the. Lenders consider your debt-to-income ratio, or DTI, a key factor when determining your eligibility for a mortgage. Paying off a car loan can potentially lower. The truth is, car loans in good standing can boost your credit score over time. But when you first make the purchase, since there is no payment history. Using your home equity as collateral can help you finance your car at a low interest rate. But securing a loan with your house means that, if for some reason. You are using money you've already paid on your mortgage, and home equity loans can have very low monthly payments in comparison to auto loans. That's. Different lenders charge auto loan interest rates depending on market demand, your creditworthiness, how much you're borrowing compared to the vehicle's value . Generally no you cannot. When purchasing a home the mortgage is issued a bit backwards from refinancing. The loan looks at the sales price and. Robins Financial has no pre-payment penalties on our auto loans. Missing Payments. Stay on top of the entire refinance process, and don't assume anything is a. Apply for an Auto Loan today Qualifying loans include mortgage, home equity, auto, and credit card. A qualifying loan must have a current balance and. You could ask the lender if you can put extra money on the auto loan when it fits your budget. This can help you to pay less back, overall—and, at SCCU, the. Lenders consider your debt-to-income ratio, or DTI, a key factor when determining your eligibility for a mortgage. Paying off a car loan can potentially lower. The truth is, car loans in good standing can boost your credit score over time. But when you first make the purchase, since there is no payment history. Using your home equity as collateral can help you finance your car at a low interest rate. But securing a loan with your house means that, if for some reason.

It can be much cheaper to finance a car using your house as security. Looking at the current interest rates for car loans on planeta-avto-vostok.ru most are over 10%. So, if you're in the midst of applying for a mortgage loan, you may want to wait a while before refinancing your car — or you could do both through the same. A longer loan also puts you at risk for negative equity, which is when you owe more on the vehicle than the vehicle is worth. Loan-to-value ratio. A loan-to-. Robins Financial has no pre-payment penalties on our auto loans. Missing Payments. Stay on top of the entire refinance process, and don't assume anything is a. However, many people find that getting approved for a car loan is a little easier than the approval process for a mortgage. This is because mortgages tend to. Can I get approved for an auto loan before I pick out my car? Yes. That's called a preapproval, and it allows you to know exactly how much car you're. Your lender will check your credit and, if you're approved, will tell you your options for interest rates, terms and payments. Should you accept their approval. A: Monthly payments for some auto loans may not be calculated the same way a mortgage loan is. Mortgage payments. For mortgages, the process of amortization is. One option is to use your car title for a title loan, which uses your car as collateral for a short-term loan, putting cash in your hand immediately and helping. A: Monthly payments for some auto loans may not be calculated the same way a mortgage loan is. Mortgage payments. For mortgages, the process of amortization is. There are some small differences in the way in which extra payments are credited on car loans and home mortgage loans, which are related to the fact that. Apply for auto loans and refinance for any credit situation. Find and use a loan such as a car loan or mortgage. The process may not have a flat. How Does A Car Loan Affect Your Ability To Get A Mortgage? When reviewing a home buyer's credit-worthiness, lenders look at all existing loans: car loans. Every mortgage loan program has specific guidelines about how high a borrower's DTI can be. Even if you feel confident you can afford the car loan and a new. Once you and the borrower have agreed on a selling price for the car, it's time for the borrower to submit an application for a new loan. The borrower will have. Can I Combine Car Loans & Mortgages? · Adding in the Car. Consider the car loan principal and its monthly payments. · The Total Loan Amount. Add the remainder of. A Truist Personal Line of Credit offers flexible access to cash when you need it. % APR Excellent credit required for lowest rate. Truist Auto Loan. You are using money you've already paid on your mortgage, and home equity loans can have very low monthly payments in comparison to auto loans. That's. The interest earns interest over time with compound interest so the total amount paid snowballs. Amortization. Auto loans are amortized just like mortgages. The. Auto loans key terms Amortization describes the process of gradually paying off your auto loan. In an amortizing loan, for each of your monthly payments, a.

2 3 4 5 6